Automotive Steel Market Projected to Reach USD 161.01 Billion by 2032

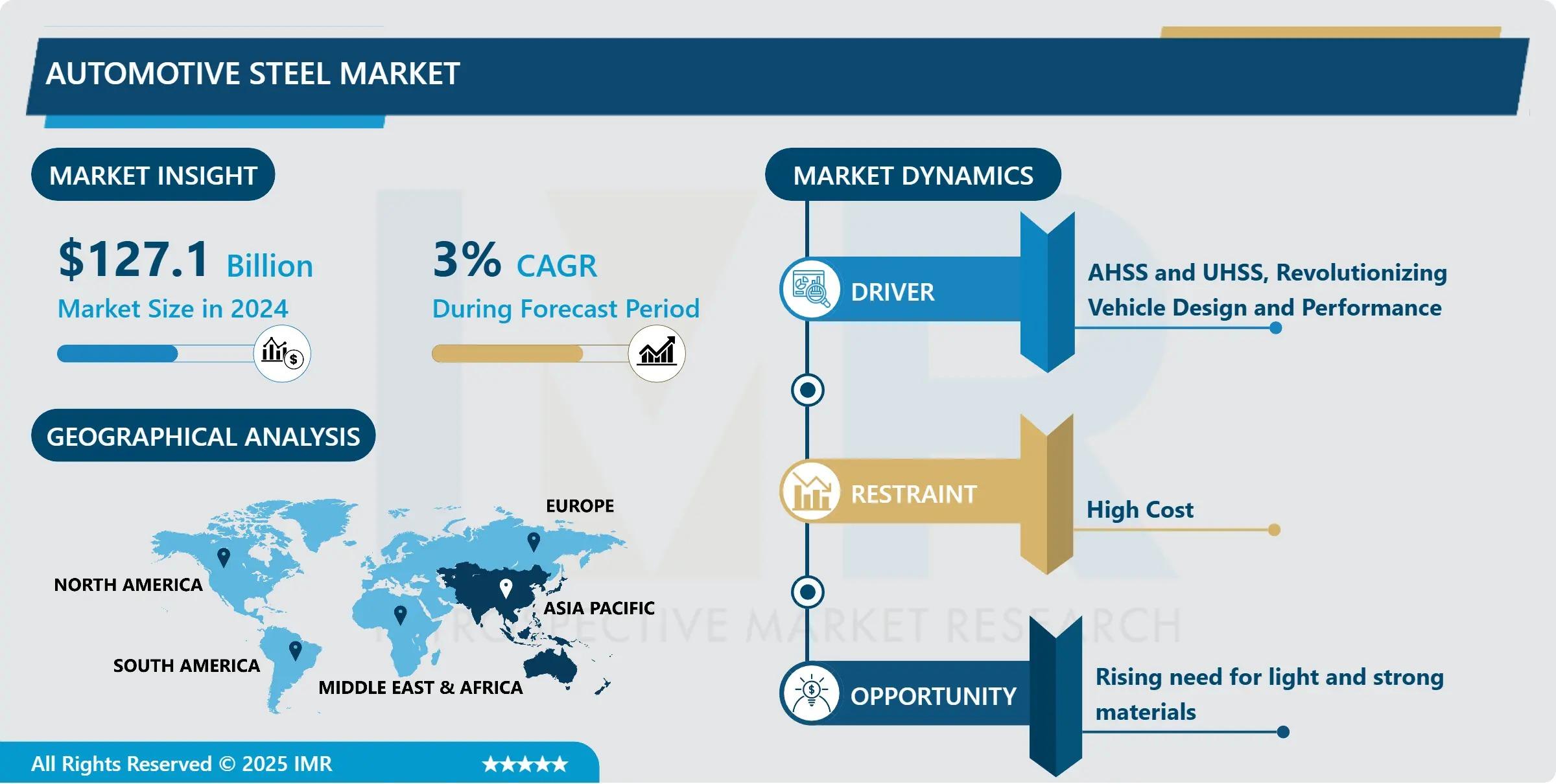

According to a new report published by Introspective Market Research, the Global Automotive Steel Market by Product, Vehicle, and Application, valued at USD 127.1 Billion in 2024, is projected to reach USD 161.01 Billion by 2032, growing at a CAGR of 3% from 2025 to 2032. The market's steady expansion is primarily attributed to the global automotive industry's pivot towards vehicle lightweighting, stringent emission regulations, and the rapid growth of electric vehicle (EV) production.

Steel remains the backbone of automotive manufacturing, prized for its exceptional strength, durability, and cost-effectiveness. Today's automotive steel has evolved far beyond traditional grades, with a strong focus on Advanced High-Strength Steel (AHSS) and Ultra-High-Strength Steel (UHSS). These advanced materials provide an optimal strength-to-weight ratio, enabling manufacturers to reduce vehicle mass a critical factor for improving fuel efficiency in internal combustion engine vehicles and extending the driving range of electric vehicles.

Driver: The Imperative for Vehicle Lightweighting

A primary driver propelling the automotive steel market is the global regulatory push for improved fuel efficiency and reduced carbon emissions. Governments worldwide have implemented stringent standards, compelling automakers to reduce vehicle weight. Advanced High-Strength Steel (AHSS) is central to this strategy, as it allows manufacturers to design thinner, lighter components without compromising passenger safety or structural integrity. For instance, studies indicate that a 10% reduction in vehicle weight can improve fuel economy by 6-8%. This regulatory environment, coupled with consumer demand for more efficient vehicles, ensures sustained investment and innovation in high-performance steel grades that meet these dual demands of lightness and strength.

Opportunity: Specialization for Electric Vehicle Platforms

The accelerating transition to electric vehicles represents a substantial and long-term growth opportunity for the automotive steel industry. Unlike traditional vehicles, EVs have unique material requirements, particularly for battery protection and crash management systems. This drives demand for specialized, high-strength steel grades for battery enclosures that must be lightweight, rigid, and safe. Furthermore, the proliferation of EV models across all vehicle segments ensures a broad and expanding addressable market. Steel producers who can collaborate closely with automakers to co-develop and supply these tailored solutions for next-generation EV platforms are poised to capture significant value and secure their relevance in the future automotive ecosystem.

The Automotive Steel Market is segmented on the basis of Product, Vehicle Type, and Application.

Product

The Product segment is further classified into Low-strength Steel, Conventional HSS, Advanced High Strength Steel (AHSS), and Others. Among these, the Advanced High Strength Steel (AHSS) sub-segment accounted for the highest market share. AHSS is the cornerstone of modern vehicle design, enabling significant weight reduction while enhancing crash safety. Its superior strength-to-weight ratio allows for the down-gauging of parts, directly contributing to better fuel efficiency and lower emissions. Major steelmakers are continuously innovating within this category, developing next-generation AHSS with improved formability and strength, making it indispensable for manufacturing critical components like pillars, door rings, and bumpers in both electric and conventional vehicles.

Vehicle Type

The Vehicle Type segment is further classified into Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, and Two-wheeler Vehicles. Among these, the Passenger Vehicles sub-segment accounted for the highest market share. This dominance is linked to the sheer volume of global passenger car production and the intensive use of steel per vehicle. The segment benefits from rising consumer demand, expanding middle-class populations in Asia-Pacific, and the integration of more AHSS content per car to meet safety and efficiency standards. The ongoing consumer shift towards Sports Utility Vehicles (SUVs), which typically utilize more steel due to their larger size and safety requirements, further solidifies this segment's leading position.

Some of The Leading Market Players Are:

· ArcelorMittal (Luxembourg)

· TATA Steel (India)

· Nippon Steel Corporation (Japan)

· POSCO (South Korea)

· Hyundai Steel (South Korea)

· China Steel Corporation (Taiwan)

· United States Steel Corporation (USA)

· JFE Steel Corporation (Japan)

· NUCOR Corporation (USA)

· JSW Steel (India)

· Thyssenkrupp AG (Germany)

· HBIS Group (China)

· SSAB (Sweden)

· Baowu Steel Group (China)

· Voestalpine AG (Austria)

and other active players.

Key Industry Developments

News 1: Focus on Sustainable "Green Steel"

In June 2024, Tata Steel Nederland launched Zeremis Recycled, an automotive steel product containing a guaranteed minimum of 30% recycled content. This initiative is part of a broader industry movement to produce "green steel" with a lower carbon footprint.

The launch directly addresses the automotive industry's pressing need for sustainable materials, helping car manufacturers meet their own carbon neutrality and circular economy targets without compromising on material performance or safety standards.

News 2: Strategic Partnerships for Low-Carbon Solutions

In September 2023, LISI AUTOMOTIVE entered a strategic partnership with ArcelorMittal to develop and utilize XCarb recycled steel, a low-carbon-emissions automotive steel. This collaboration aims to integrate innovative, sustainably produced steel into critical automotive components.

The partnership underscores a key market trend where suppliers and steelmakers are collaborating early in the value chain to decarbonize vehicle production, combining expertise to reduce the overall environmental impact of the final automobile.

Key Findings of the Study

· The Passenger Vehicles segment and Body Structure application dominate global market share.

· The Asia-Pacific region is the largest and fastest-growing market, driven by massive automotive production in China and India.

· Key growth is fueled by stringent emission/safety regulations and the adoption of Advanced High-Strength Steel (AHSS) for lightweighting.

· The rise of Electric Vehicles (EVs) is creating new, high-value applications for specialized steel grades.

· Major players are competing through product innovation, sustainability initiatives, and strategic partnerships with automakers.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness